You can take transaction fees from app users whenever they access banking services from your banking app. It can be the most consistent revenue source for a mobile banking app because users need to pay regularly to access the app. Subscription for an app requires users to pay in advance to access app services. Try to implement these monetization models without disturbing the overall better user experience in your app. You can try different monetization models for banking apps in your business. Best online banking app monetization strategies in a nutshell In the next section, let’s find out some popular monetization strategies for banking apps. You may ask how this mobile banking app makes money. The monetization model comes in the form of subscriptions, advertising, fee schedules, etc. The better you choose a monetization strategy, the sooner your development cost will pay off. You can choose any monetization model to make money from your banking app.

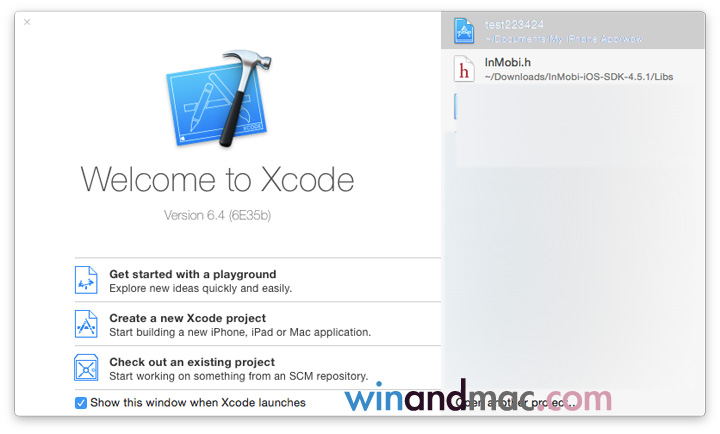

Bank xcode app software#

You can make the right decisions by choosing a well-experienced software development company. Finding a reliable software vendorĬhoosing the right software development team is half the battle for making a super-performing banking app. It will help you point out the competitor’s app drawback that you can improve and implement in your business. Also, you can create a better market strategy by doing market research. It helps to cover all-rounder market research. Market Analysis is the foundation of banking app development. Doing market analysis and project planning Steps Needed for Banking App Developmentĭeveloping mobile apps needs an all-rounder preparation and can be done in various steps. It can improve the overall business model of your mobile banking app. It is a better opportunity for entrepreneurs to create apps for online banking to make profits in the app business.Īfter knowing the market size of mobile banking apps, you can find some critical app development steps in the next section.

The global fintech market attained a value of approximately USD 194.1 billion in 2022 and is expected to grow in the forecast period of 2023-2028 at a CAGR of 16.8% to reach USD 492.81 billion by 2028. The market size of FinTech apps (digital banks) The mobile banking app’s benefits become the reason for its fast adoption worldwide let’s look at its overall market size growth. Checking transaction history and details effortlessly (passbook)Īlso, there are many reasons for gaining the importance of mobile apps in the banking sector, such as:.

Bank xcode app password#

It also protects users from online fraud by applying password protection, OTP verification, and other security features.Īlso, other features of the banking app are as follows: Advanced technologies for digital banking apps!ĭigital banking app lets users access online banking services from mobile devices, such as checking account balance, fund transfer, generating account statements, paying bills, etc.Ī banking app allows its users to access all online banking services 24*7.Most popular technologies for Fintech apps!.Choosing a tech stack for your banking app?.Best online banking app monetization strategies in a nutshell.Steps Needed for Banking App Development.The market size of FinTech apps (digital banks).Salon App Development for Salons and Spas.

Entrepreneurs Key to Boosting Conversions E-Book.

0 kommentar(er)

0 kommentar(er)